Goldman Sachs Get Optimistic On Space Mining Possibilities

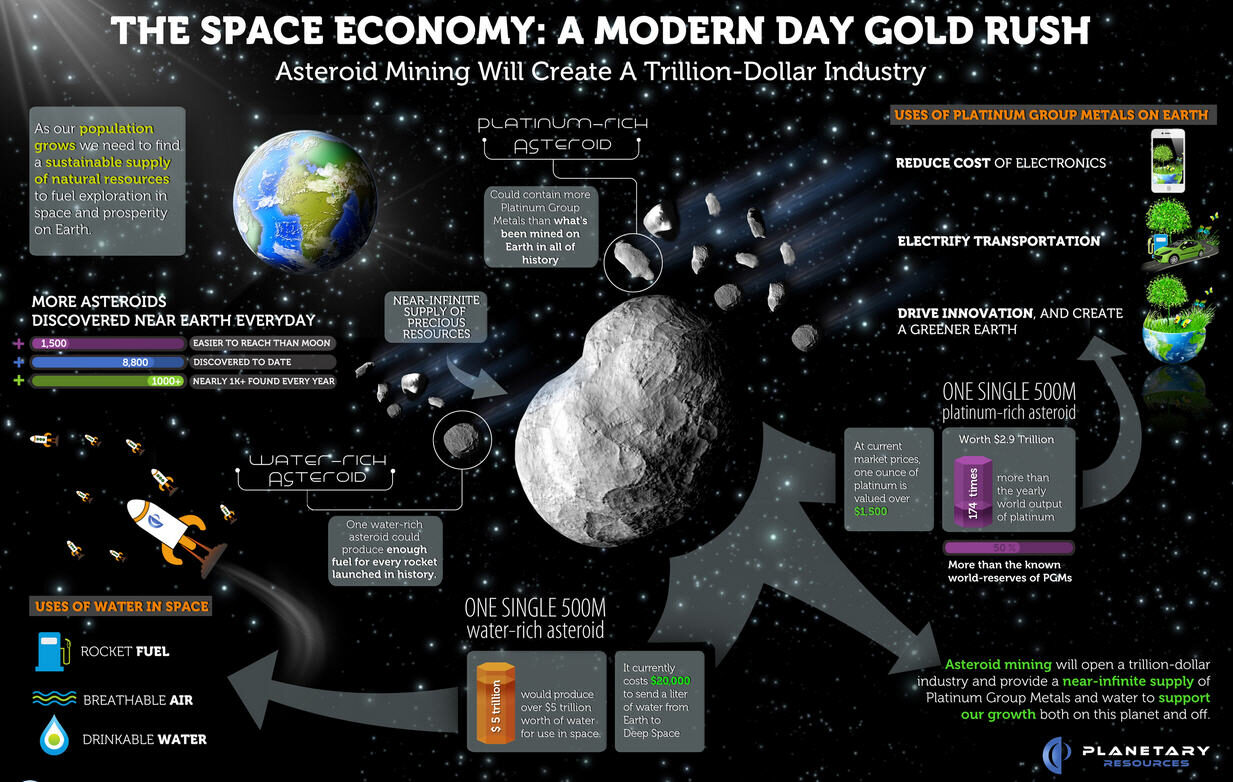

Financial analysts at the firm have revealed that mining for resources in space is not as outlandish as it sounds, and might soon be on the same level as mining for resources on Earth in terms of cost and reward. They emphasize that space is getting cheaper to access, technology is developing faster than ever and the rewards from mining materials such as titanium could be monumental.

“While the psychological barrier to mining asteroids is high, the actual financial and technological barriers are far lower. Prospecting probes can likely be built for tens of millions of dollars each and Caltech has suggested an asteroid-grabbing spacecraft could cost $2.6bn,” the report says.

Whilst this figure might seem like a huge investment, a regular mine on Earth can require more than a billion dollars of investment to yield returns. Venture capitalists and investment consortiums often put this level of investment into new projects if they firmly believe in the value of it. Companies such as Uber have received much more in the way of investment and have been very successful.

One factor in the report is the success of SpaceX’s reusability of first stage boosters. Getting payloads into space once cost a fortune, but the price of sending satellites into orbit has since plummeted since the reusable technology involved has been proven to work. SpaceX are not the only company working on reusability for their rockets as the industry has seen that this is an effective method to reduce the cost of spaceflight.

“Space mining could be more realistic than perceived. Water and platinum group metals that are abundant on asteroids are highly disruptive from a technological and economic standpoint. Water is easily converted into rocket fuel, and can even be used unaltered as a propellant. Ultimately being able to stockpile the fuel in LEO [low earth orbit] would be a game changer for how we access space. And platinum is platinum. According to a 2012 Reuters interview with Planetary Resources, a single asteroid the size of a football field could contain $25bn- $50bn worth of platinum.”

The biggest problem Goldman Sachs foresee is with market stability. If we brought back that smallish-sized asteroid and quickly brought the titanium down to Earth and refined it, the demand might plummet as manufacturers get their hands on the new loads.

“Successful asteroid mining would likely crater the global price of platinum, with a single 500-meter-wide asteroid containing nearly 175X the global output, according to MIT’s Mission 2016.”

Goldman Sachs are still interested in space mining possibilities and say that it will not be long before investors are piling cash into new missions to look for resources elsewhere.

“We expect that systems could be built for less than that given trends in the cost of manufacturing spacecraft and improvements in technology. Given the capex of mining operations on Earth, we think that financing a space mission is not outside the realm of possibility.”

It might be seriously cool buying products that have a label stating that raw resources used in the manufacture of this product were mined in space.